How to Survive a Recession

- Ben Clarke

- Jan 8, 2023

- 3 min read

Updated: Jan 14, 2024

Getting through a recession/depression (mostly) unscathed.

*Not financial advice - your money, your choice*

Economists are saying a recession is imminent… What does this mean and how can you prepare?

For a long time, it was known that a Recession was 2 consecutive quarters (6 months) of negative GDP (gross domestic product) growth and for the UK that's still the definition. The us has a more vague definition that requires a handful of economic metrics to be analyzed by a panel of economists who make it official. To keep it simple, we'll be using the UK definition.

Quick Refresher on GDP: This is the amount of goods/services that a country produces. When GDP is negative it means that the country is producing less when comparing 2 periods (usually last 3 months vs 4-6 months ago). Ex: Last quarter I made 100 cookies but this quarter I made 90 cookies. That's negative growth of 10%. Confusing wording? I know, I think so too.

Graph from BenjaminsWithBen.com

Okay, now that we know what GDP is and what a recession is, also know that the actual ‘declaration’ of a recession is decided by a bunch of economists.

They get together and are like ‘Basically, because of negative GDP and also high unemployment and some other bad stuff, we're now in a recession.’.

So how do we know we are going into a recession?

We don't… until about a year after it happened.

BUT there are some things we can pay attention to that can give us a better idea. Those indicators that have worked pretty well for telling if there will be a recession are…

Interest Rates: How much banks and the government charge for borrowing money. Low-interest rates = cheap money.

Unemployment Rate: How many people don’t have a job but who are actively looking for a job.

Job Availability: How many jobs are available for every unemployed person.

Quit Rates: How many people are willingly leaving jobs (not layoffs/firings).

Layoffs: How many people are being asked to leave companies because the company can no longer afford to maintain the same size workforce.

So how to prepare?

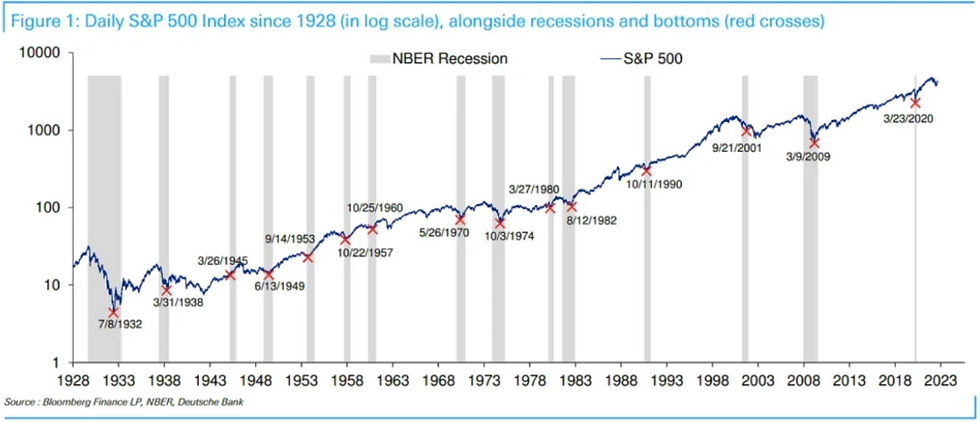

Time and time again we have found that recessions are the best place to ‘buy the dip’. This is when the values of securities (stocks, bonds, etc.) fall.

This makes it a perfect time to be investing even though indicators look a bit sh*t. It also means that the stock market has probably been falling for a while which means Cash has been performing better than stocks.

That said, no one knows where the bottom is. This means that 11/10 times it's a better idea to dollar-cost-average in the market.

‘Dollar-cost-average’ means putting a set amount into the market on a regular recurring basis (daily is best).

If you decide to dollar cost average of $1,000/mo into an S&P 500 index fund, over the next 20 years you’d likely make $267,536 on interest alone (assuming a 7% interest rate). AND you would end up with a total of $507,536:

Check out Investment Calculator from Calculator.net

Read more about the power of interest here.

If you tried to time the dips and missed 20 best days over the course of 20 years then you’d come out with negative returns. (JP Morgan data from 1999-2018)

You’d be below the blue line on the above graph. This is why the phrase ‘Time in the market beats timing the market,’ exists.

Talk to anyone in the finance industry, pretty much everyone just dollar cost averages into the market on a daily, weekly, or biweekly basis into products like VTI, VOO, and QQQM because they know they are very unlikely to beat the market by trading individual stocks or ETFs. Not sure what a stock or ETF is? Click here.

After all, less than 1% of people can beat the market over the long term. (Performance Investment Group)

Even 90% of financial professionals can’t beat the market over a 15-year period (American Enterprise Institute, Aei.org).

And you can automate it which means you don’t have to pay a 1-2% management fee. I'll cover how to do this in a future post and will also include it in a future course.

I’ll also explain why management fees, be it from a hedge fund or financial advisor, or wealth manager if you’re fancy, is not worth it in a future article. To provide additional perspective, I'll also have an article explaining the benefits of hiring an advisor or other financial professional plus to how to pick an advisor if you decide you need one.

If you found this helpful, consider subscribing to my YouTube channel, or newsletter, or follow me on social! If you have any comments please leave them on this post - I love hearing what you have to say + if there’s anything you want to be covered next!

Click here to go back to the home page and check out different posts.

Commentaires